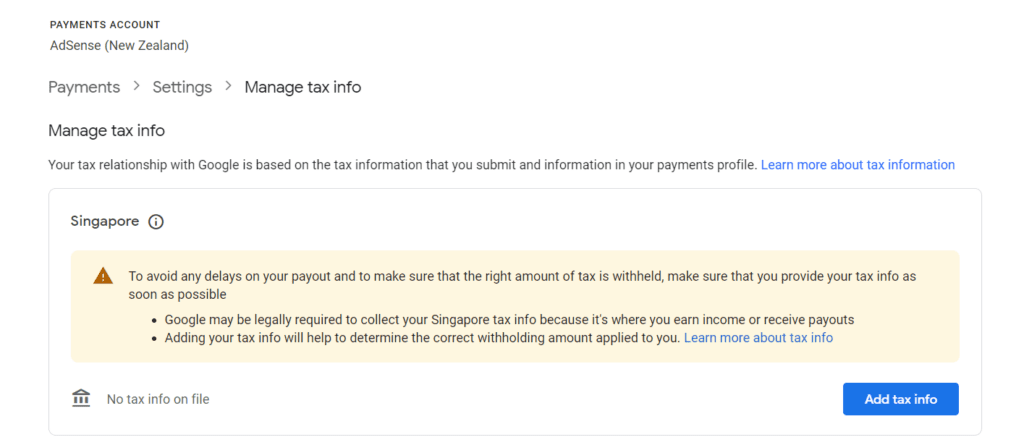

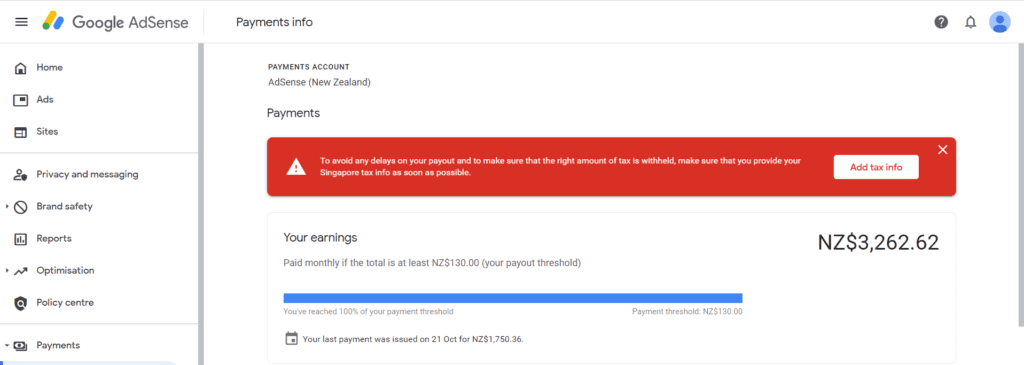

If you are an AdSense or Admob publisher, you might have seen an error “To avoid any delays on your payout and to make sure that the right amount of tax is withheld, make sure that you provide your Singapore tax info as soon as possible.” under the payments section. Even though your address is not based in Singapore or you don’t have any business registered in Singapore, you still see this red warning message.

People from the following countries have already reported this “Singapore Tax info” warning on their AdSense portal.

- Pakistan

- Vietnam

- Australia

- New Zealand

- India

and so on.

How to Fix the “Singapore Tax info” section in Google Adsense to avoid payout delays and avoid tax withheld?

You can fix this warning within a few minutes.

Step 1:- Go to the Payments Section in Adsense.

Step 2:- Click on the “Add tax info” button.

Step 3:- Fill in the information as follows.

What is your business type?

Depending on your business type, you can fill out this field. Most people would be individual/sole proprietor. Make sure you have provided it as how you initially setup the Adsense account. If your account is based on a business, choose business.

Do you have a permanent establishment in Singapore?

You can select NO under this question. A permanent establishment is a physical space, such as an office or warehouse, or ongoing services performed for the operation of a business. Consult your tax adviser to determine if you have a permanent establishment.

Are you registered for Singapore Goods and Services Tax (GST) under the overseas vendor registration regime?

Select No for this question. The Overseas Vendor Registration (OVR) regime requires suppliers outside Singapore to register, charge and account for GST on sales of digital services to customers in Singapore.

Are you eligible for tax exemptions?

You can select NO for this question. However, there are many countries where there is a tax treaty with Singapore. If you are based in such countries, you can select YES and you may be eligible to be taxed at a lower withholding rate.

Are you eligible for other exemptions or lower tax rates?

Select NO.

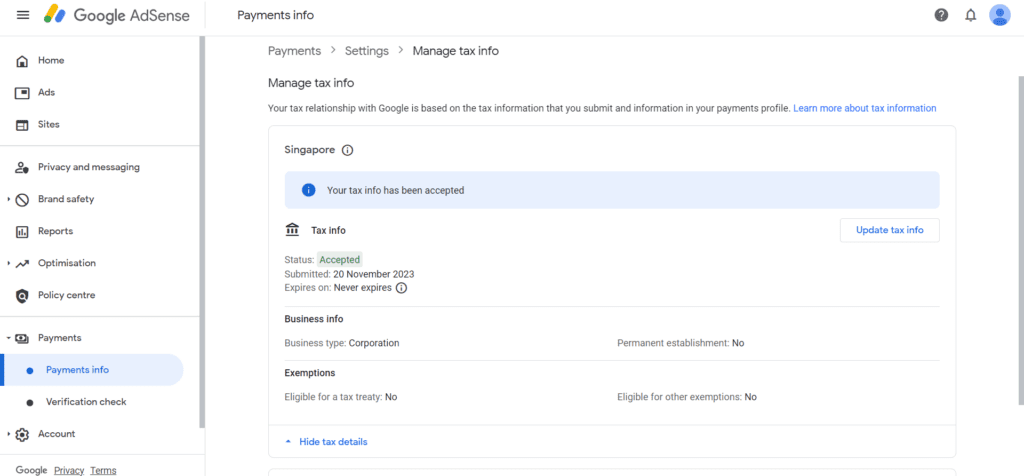

Step 4:- Once you fill information as above, click on the submit button.

If you have filled in the information as mentioned above, you will see the tax info status as Accepted. Now you don’t need to pay Singapore tax for your Adsense earnings.